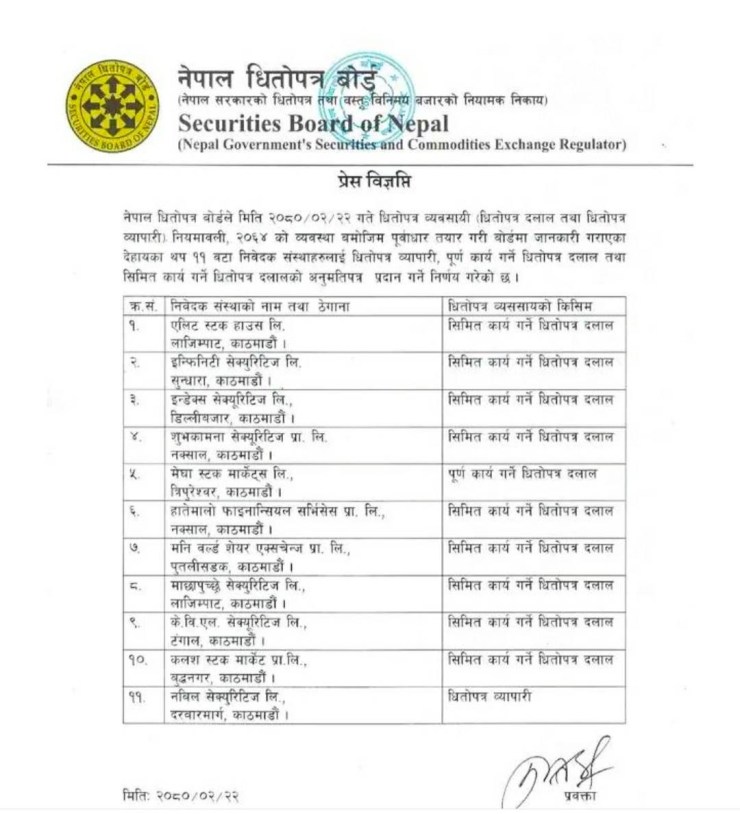

SEBON grants licenses to 11 new stock brokers

The Securities Board of Nepal (Sebon) has granted licenses to 11 new companies to act as stock brokers in Nepal’s securities market.The board issued the licenses on Monday, June 5, 2023. The 11 companies that received licenses are: Elite Stock House Limited, Lazimpat, Kathmandu Infinity Securities Limited, Sundhara, Kathmandu Index Securities Limited, Dillibazar, Kathmandu Shuvakamana […]