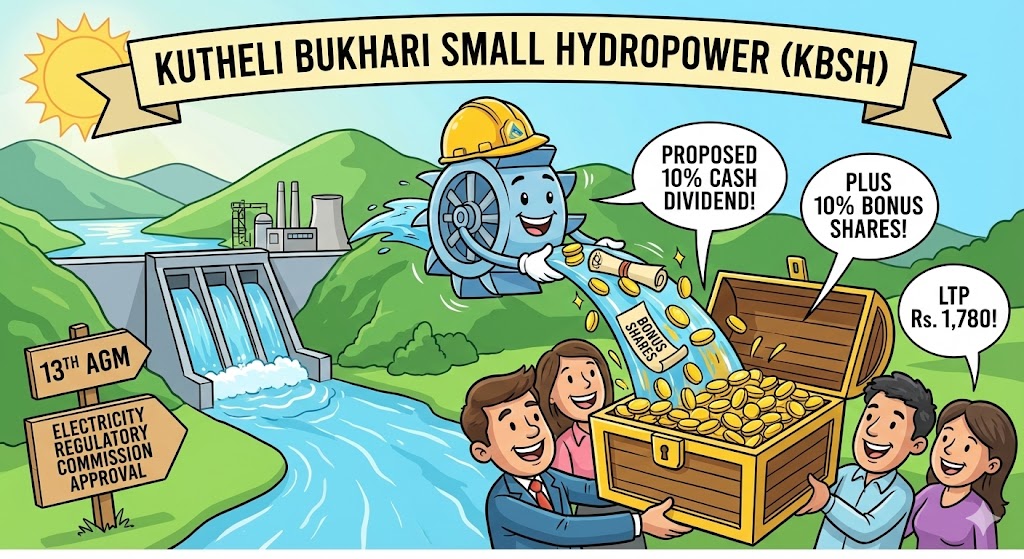

Kutheli Bukhari (KBSH) Announces 10% Dividend & 10% Bonus Shares

Good news for small-cap investors: Kutheli Bukhari Small Hydropower Limited — often called KBSH — has proposed a 10% dividend for the fiscal year 2081/82. Along with the cash dividend, the company also proposed a 10% bonus shares issue worth Rs. 1.34 Crores. This update is important for anyone following hydropower stock Nepal or dividend […]