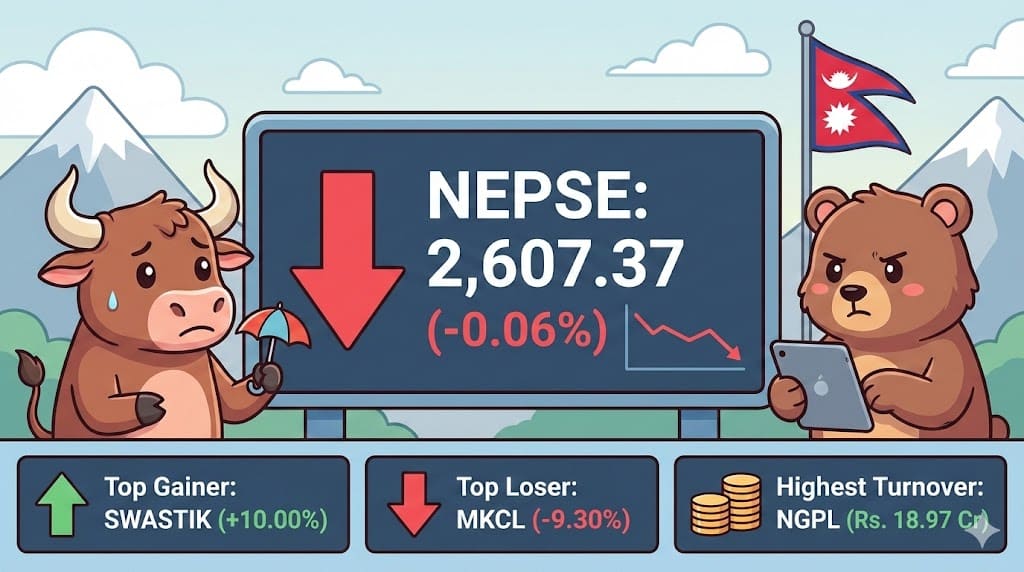

NEPSE Today: Minor Dip as Market Closes Red — Key Movers, Sector Highlights & Turnover Update

The Nepal Stock Exchange (NEPSE) closed lower today, dipping by 1.66 points (0.06%) to end at 2,607.37. This minor decline follows yesterday’s drop, continuing cautious sentiment across the Nepal stock market. NEPSE Index Movement — Daily Summary The NEPSE Index opened at 2,608.11, touched an intraday high of 2,611.99, and fell to a low of […]