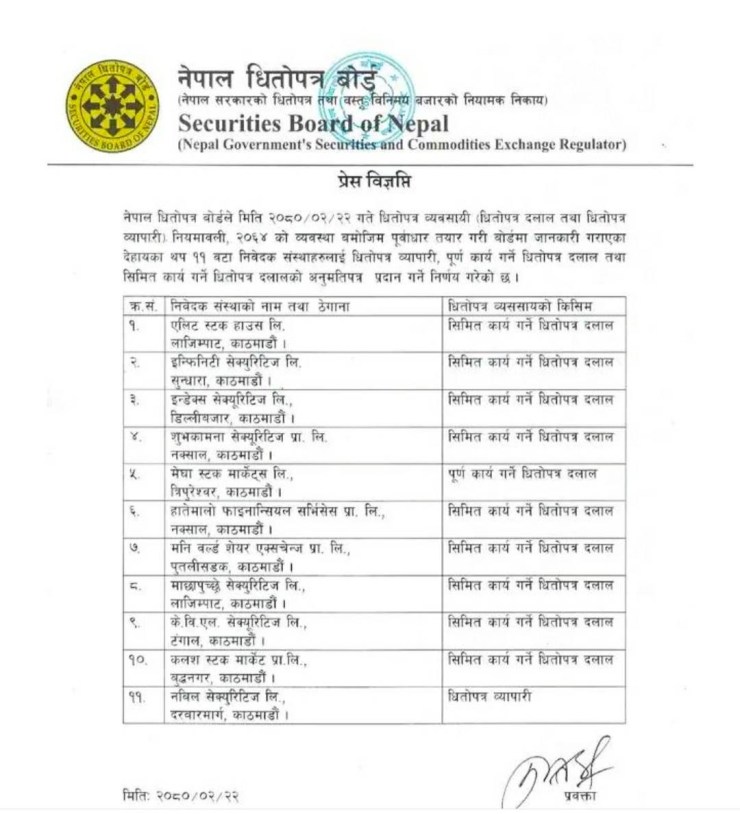

The Securities Board of Nepal (Sebon) has granted licenses to 11 new companies to act as stock brokers in Nepal’s securities market.The board issued the licenses on Monday, June 5, 2023.

The 11 companies that received licenses are:

- Elite Stock House Limited, Lazimpat, Kathmandu

- Infinity Securities Limited, Sundhara, Kathmandu

- Index Securities Limited, Dillibazar, Kathmandu

- Shuvakamana Securities Pvt. Ltd, Naxal, Kathmandu

- Mega Stock Markets Limited, Tripureshwore, Kathmandu

- Hatemalo Financial Services Pvt. Ltd, Naxal, Kathmandu

- Money World Share Exchange Pvt. Ltd, Putalisadak, Kathmandu

- Machhapuchchhre Securities Limited, Lazimpat, Kathmandu

- K.B.L Securities Limited, Tangal, Kathmandu

- Kalash Stock Market Pvt. Ltd, Bhddhanagar, Kathmandu

- NABIL Securities Limited, Durbarmarg, Kathmandu

With the issuance of these licenses, the total number of securities dealers in Nepal has increased to 69. Of these, 50 are full-time securities brokers and 19 are limited-time securities brokers.

The Sebon has been issuing licenses to new securities dealers in order to expand the reach of the stock market and to increase the number of investors. The board has also been taking steps to improve the regulatory framework for the securities market.

The issuance of licenses to 11 new companies is a positive development for the Nepali stock market. It will help to increase the number of investors and to deepen the market. It will also help to improve the liquidity of the market.

Sebon is expected to continue to issue licenses to new securities dealers in the coming months. This will help to further expand the reach of the stock market and to increase the number of investors.